How To Reduce Employee Turnover with Workforce Analytics

The right workforce analytics framework should help develop tailored employee turnover solution and design a tailored employee retention programs.

A data-driven approach to analyzing employee turnover can empower your organization to identify why people leave and boost retention.

Employee retention is a key objective for most HR organizations, and employee turnover is the single most prevalent HR metric. However, knowing your turnover rate does little to support strategic business plans. To achieve true insight, a more in-depth analysis of what’s causing turnover in different parts of the organization is required.

Why should HR make employee retention a priority? Data from the Work Institute 2022 Retention Report reveals the state of employee retention and turnover.

More than 68% of employees who quit could have been retained

More than 47 million employees quit their job voluntarily 2021

Voluntary turnover costs exceeded $700 billion in 2021

HR, with its understanding of human capital dynamics, is uniquely positioned in the organization to ensure the workforce is aligned with the needs of the business at the optimal cost.

Now, more than ever, business leaders need strategic insight and the ability to model how turnover trends impact revenue and profits—quickly and accurately.

What is employee turnover?

Employee turnover is the proportion of the employees who leave an organization over a set period.

Because of all the different factors that affect turnover, it’s important to look at these numbers in-depth before saying you have a “turnover problem.” Not all turnover is bad—as in the case of a poor performer leaving—but designing employee retention programs that assume this will lower the chances of these initiatives succeeding.

As John Boudreau, professor at the Marshall School of Business, and professor and researcher at the Center for Effective Organizations at the University of Southern California, explained:

“Yet, ever-better employee turnover predictions can tempt leaders to assume that turnover is bad and must be prevented. Conversely, optimally investing in people can mean humanely encouraging employees to leave, such as in cases of poor fit and/or when better candidates exist. Optimal decisions require embedding HR analytics in a framework akin to inventory optimization, helping leaders to not simply lower turnover, but rather optimize employee turnover to enhance the long-term workforce value.”

Voluntary turnover vs. involuntary turnover

Overall employee turnover includes both voluntary leavers (those that resign or retire) and involuntary leavers (as in the case of redundancies, poor performance, or other cases where the employee was forced to leave the organization).

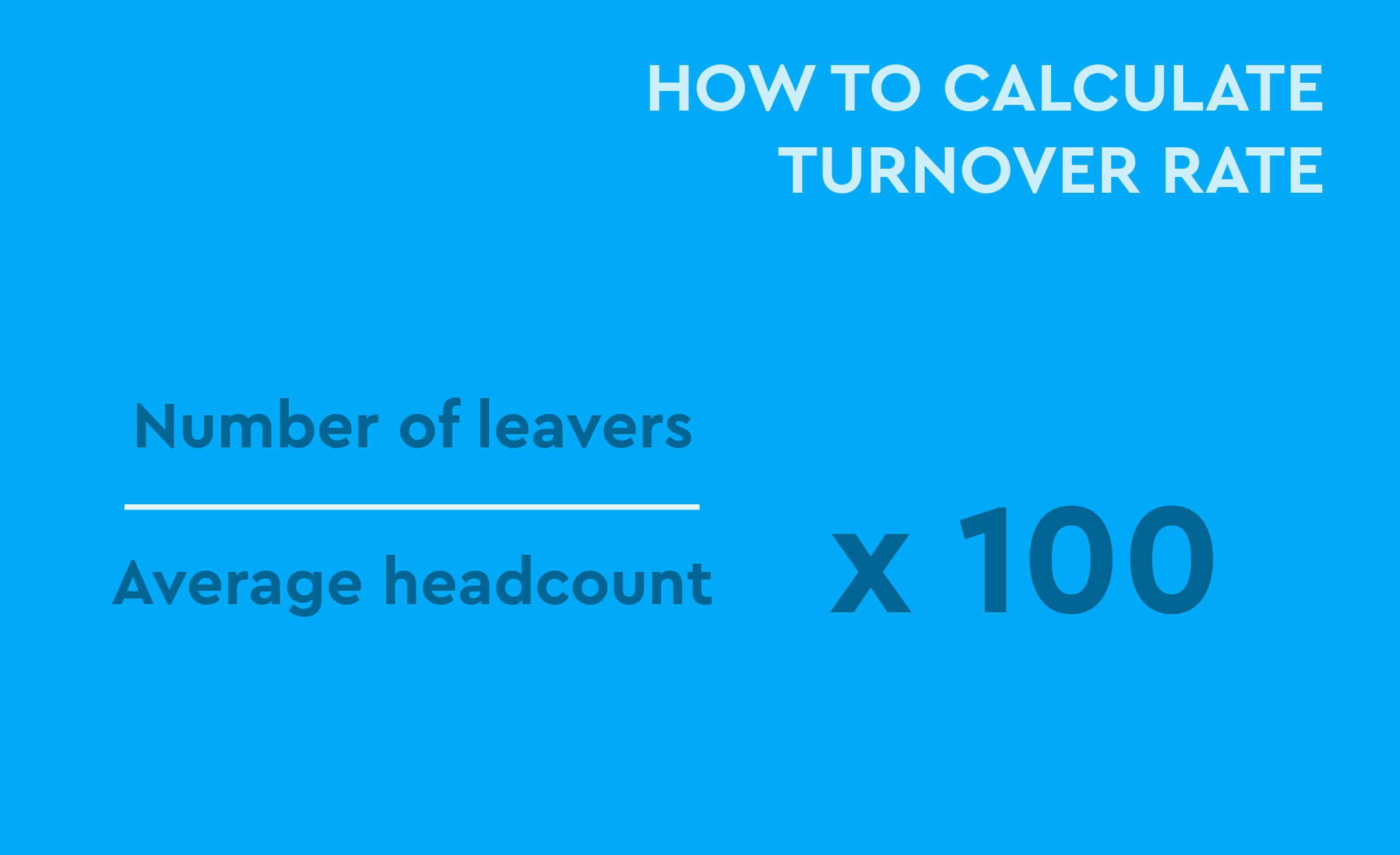

How to calculate employee turnover rate

To calculate turnover rate, start with the number of separations during a month, divide that number by the average number of employees, then multiply by 100.

However, while getting your turnover number may appear easy, the work needed to actually reduce turnover requires analysis of data from disparate systems.

For example, the top causes of turnover in your organization must be determined by looking at various dimensions of teams, managers, performance, promotions, compensation, and more. Workforce analytics platforms make it simple to uncover these insights so you make better people decisions and plans, enabling strategic excellence.

The era of workforce analytics

The desire to explore the relationships between metrics and know with certainty what levers are pulling workforce trends has ushered in the era of workforce analytics (a.k.a. ‘HR analytics’ or ‘talent analytics’). Making strategic workforce decisions without the data to back them up is as good as guessing, and it’s an issue that has long prevented HR from making a bigger impact on business outcomes.

Workforce analytics is the art and science of connecting data to discover and share insights about your workforce that will lead to better business decisions.

In order to reduce employee turnover, HR needs to become more data-driven, looking past simple descriptive analytics and towards more exploratory analytics, and (even better) predictive analytics.

Analytics in action: The employee resignation conundrum

A Visier customer told me about the time the manager of a business unit demanded a meeting with HR. The manager had noticed that more of his employees were resigning than ever before, and he wanted the company to do something about it. The manager had already come up with what he thought was the right solution—raise the base pay for all of his employees by 10%—and he now just wanted HR to execute his idea.

The HR team knew from past experience that an across-the-board pay raise was the wrong thing to do. It was an expensive way to fix the problem, and worse, it was unlikely to lead to fewer resignations. The problem was that HR had no data to prove it. Worse, the data the HR team did have only served to support the manager’s case—the data confirmed that the resignation rate had in fact increased. Given the lack of evidence to prove that an increase in base pay wouldn’t work, the people experts were left with two unsatisfying choices: Acquiesce to the manager’s demand and put the company’s headcount budget at risk, or dig up a compliance-related reason for not raising base pay—and risk annoying the manager and his team.

This unfortunate story highlights the trap many HR teams have fallen into: They’ve bootstrapped their people metrics to the point where they can answer a few basic questions about their workforce — such as the resignation rate for a given team—but they discover that a limited set of descriptive analytics isn’t enough. For many, it’s worse than having nothing.

What they need, as our customer discovered, is a way not just to see what happened, but to understand why it happened, what will happen next, and how to adapt their workforce strategy to align with company objectives.

If the HR team had been able to dig deeper into the reasons for the resignation rate increase, they could have proposed a solution that created a better business result—instead of engaging in a head-to-head conflict with the manager, supported by little more than anecdotes and gut feel.

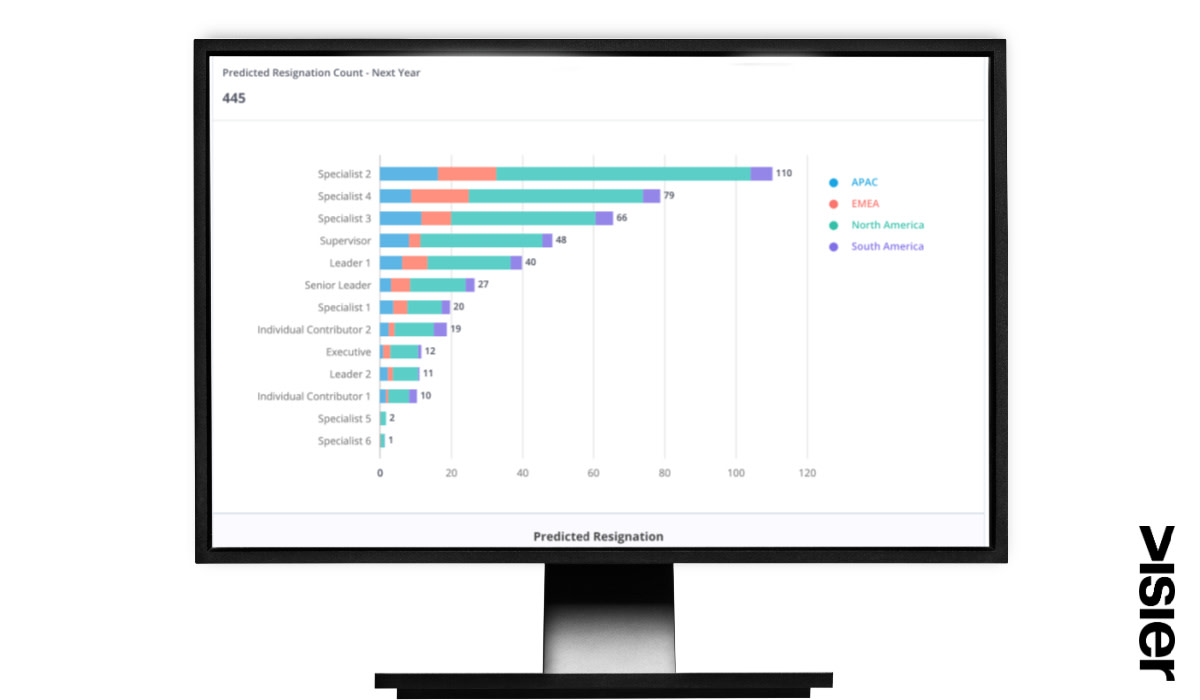

This visualization shows predicted resignation count by job family and location.

3 steps to reduce employee turnover with HR analytics

The right workforce analytics framework should help you develop turnover solutions tailored to your staff and culture. Here is a data-driven approach I recommend:

Identify your retention problem

Look for causes of employee turnover

Tackle turnover with a tailored employee retention program

1. Identify your retention problem

Determine what’s leading to higher turnover by first assessing what damage has already been done. These metrics help you accomplish this task:

Resignation rate

Surprisingly (perhaps), it is not uncommon in a single organization for turnover to be calculated a number of different ways — meaning there is a lack of ability for meaningful comparison across the organization. Start by ensuring you calculate your resignation rates the same for all departments and locations (if you have multiple offices).

As you dig into the data revealed by this metric, be sure to also take note of who exactly is resigning: Is it your top performers? Senior managers? When many of the employees who leave are your best and brightest, they take all their skills, knowledge and connections with them, putting your organization at a disadvantage.

Impact on business metrics

Stay on top of how workforce dynamics, such as resignations, are impacting business outcomes such as revenue. With fewer skilled workers available to do the work, it becomes harder to get the results needed to keep profits up and morale high. With a detailed picture of how employee exits affect other business metrics, you are better able to take proactive action to reduce any negative impacts.

2. Look For the causes of employee turnover

Once you know that you definitely have an employee retention problem, use workforce analytics to dig deep into what’s causing your staff to leave. Examine:

Resignation drivers

Building on the resignation rate, perform an analysis using a clustering algorithm to determine what factors increase and decrease resignations. This data allows you to effectively target and fine tune your retention strategies based on data (and not intuition or anecdote).

Resignation correlations

Instead of reporting single metrics, find out how resignations are affected by things such as compensation ratio, promotion wait time, pay increases, tenure, performance, and training opportunities. When you identify these correlations, you can present people with the information or compensation they’re looking for before they resign.

Determine who can be saved

As mentioned previously, implementing a one-size-fits all retention program is the antithesis of strategic HR: not all turnover is bad, particularly when it is occurring among low performers in non-critical positions but high rates of turnover can be avoided.

More than three-quarters of employees who leave organizations could be saved. When you identify what retention programs will have the biggest impacts on your workforce, you can successfully reduce turnover.

Data visualization showing what employee attributes impact resignation in a healthcare organization.

Resignation segments

By comparing how resignation rates vary across locations, functions, tenure, age and diversity groups, performance level, and more, you gain insight into how different employee populations are responding to their work experience. This insight is valuable in strategically investing in programs that will deliver the biggest results.

For example, manager behavior, well-being, and work-life balance are the top reasons female employees resign. If you are experiencing high turnover with this group, you may consider focusing on those areas of concern.

Risk of exit

This type of predictive analytics reveals which of your employees are at risk of leaving the organization before they hand in their resignation letter.

For example, the Visier solution is up to 17x more accurate at predicting who will resign over the next 3 months than guesswork or intuition — and this is invaluable because it is easier to stop a top performer from leaving than it is to bring them back.

You may not be able to stop everyone, but if you retain even a handful of key positions for more than a year, the savings can be significant.

3. Tackle turnover with a tailored employee retention program

Now that you know where you need to focus your efforts, you can start crafting a program based on an understanding of both what drives away and retains key people at your organization.

To get a picture of what motivates a group of people to stay, ask questions such as: Is it career advancement opportunities? Learning and development? Flexible work policies? If you don’t already know, have a conversation with your HR business partners and their leaders. Use these metrics to drive these discussions.

Promotions actioned

If you’ve determined that lack of career advancement opportunities is driving resignations, then you need to look at how promotions are being handled within your company. First, find the team or department that develops the most promotable people, then speak to managers from this group to see what they’re doing differently and incorporate their feedback into your solution.

It’s important to note that classic promotion metrics simply look at how many people in a group have received a promotion, but don’t indicate whether or not they were promoted within the group or came to the group from somewhere else. If you want an accurate picture of which manager is good at growing talent—or not—look instead at promotions actioned, which calculates the percentage of people being promoted from the organization that they worked for at the start of the time period being reviewed.

Training impact on performance and promotions

A demanding workload can leave little time for an employee (or other critical talent) to spend on learning, which holds them back from advancing their careers.

If you need to justify a learning budget increase or time allocated to learning, this metric can reveal the correlation between a higher investment in training and high performance and promotions.

New hire performance

Insights into new hires tell you whether new staff members are getting up to speed effectively. This can tell you if you need to improve your onboarding program or look into their manager’s effectiveness—it could be a sign that the manager needs help creating a better onboarding experience for new hires.

Retirement trends

While retirements are bound to happen at some point, workforce planning will help you determine how many positions these employees will eventually be leaving vacant.

This insight demonstrates how important L&D will be and enables you to put a program in place that ensures junior staff will have the skills necessary to take over the roles of retiring senior employees.

Choose the right workforce analytics solution for the job

Doing the kind of analytics needed to effectively reduce employee turnover can’t easily be accomplished on multiple spreadsheets or by querying disparate HR systems to get the correct data. An investment in the right people analytics solution is the key to achieving this.

In fact, exploring new technologies—especially those based in the cloud—is always a popular recommendation in the Global Human Capital Trends report by Deloitte.

With the right workforce analytics solution, you will be able to better understand and take evidence-based corrective actions to reduce unwanted turnover, focusing on top talent, critical positions, successors, and other “must keep” groups.

There are three capabilities to look for in workforce analytics to maximize your ROI:

Solution identifies and ranks, in real time, all factors contributing to resignations, so strategies can be implemented to reduce rates and retain high-performing or critical employees

Solution is proven to accurately predict employees likely to retire, taking into account all possible employee attributes

Solution allows you to compare resignation rates across locations, functions, tenure, age groups, diversity, and other groups to ensure program investments are targeted where they will deliver most impact

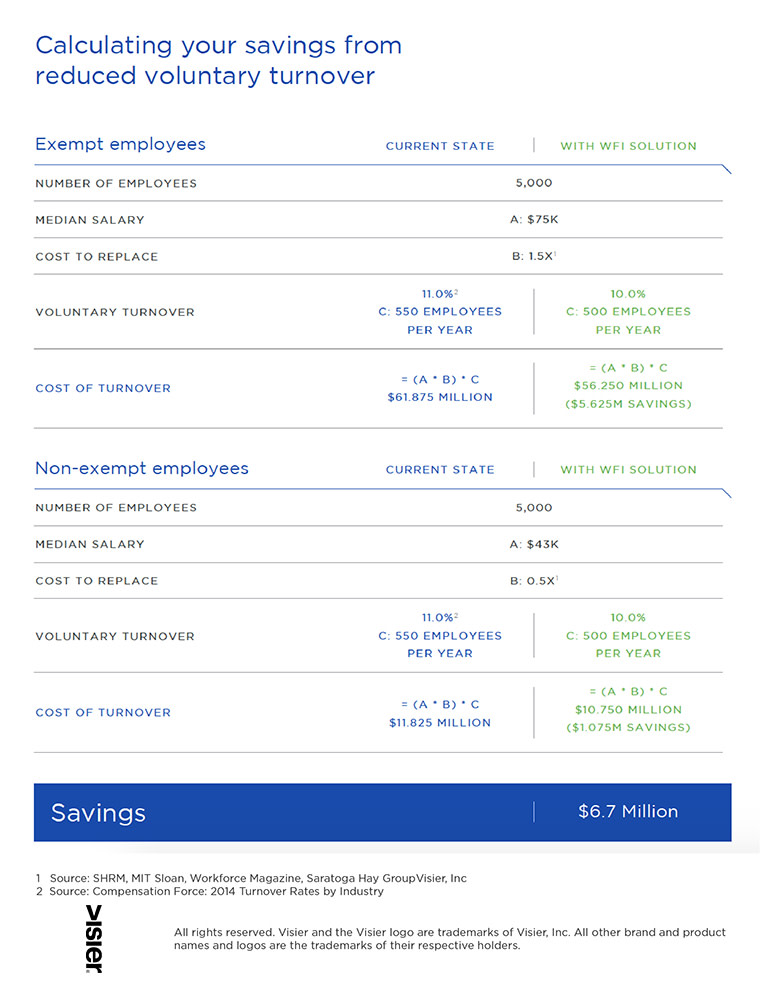

For a more quantitative look at your expected savings, refer to the table below, which shows an example of savings achieved by reducing voluntary turnover–broken out by non-exempt and exempt labor, using industry standard cost factors that include recruitment, training, loss of productivity, and new hire costs.

Deliver the right employee retention results for your company

The datafication of HR is bringing an end to the one-size-fits-all era of talent retention programs. For instance, First West Credit Union used data to learn about a retention problem, leveraged Visier’s people analytics platform to laser in on the issue, focused their interventions, and reported back to the business the $500k saved in turnover costs and the additional $2.5M in revenue generated through retention and productivity.

The new approach to HR requires evidence to support a well-crafted employee retention program—tied to a key business outcome—which is monitored and adapted constantly.

Before rushing to introduce a new set of variables into your complex workforce environment, stop and adopt a more scientific approach to the design and implementation of these programs. This way you will get full support for what your business really needs: a retention program that works.

Looking to learn more? Continue reading:

On the Outsmart blog, we write about workforce-related topics like what makes a good manager, how to reduce employee turnover, and reskilling employees. We also report on trending topics like ESG and EU CSRD requirements and preparing for a recession, and advise on HR best practices how to create a strategic compensation strategy, metrics every CHRO should track, and connecting people data to business data. But if you really want to know the bread and butter of Visier, read our post about the benefits of people analytics.

Get the Outsmart newsletter

You can unsubscribe at any time. For more information, check out Visier's Privacy Statement.