How To Keep HR and Finance in Sync on Headcount Planning

Effective workforce planning requires HR and Finance work as a team. Here's how HR and Finance can keep in sync during three core stages.

Effective workforce planning requires HR and Finance to work as a team if they want to drive business outcomes with agility and impact. With economic uncertainties, leadership teams are looking for ways to control their workforce expenses. Headcount planning is what you use to inform how much—or how little—a company can spend on its workforce.

Nothing affects profit margins and operational runway like headcount. Nothing builds organizational resilience like combining workforce data with plain old work data. In this post, we're sharing how HR and Finance can create a more sustainable workforce strategy by joining people and work data.

What is headcount planning?

Headcount planning is a strategy organizations use to ensure they have the right type and number of employees, and the right organizational structure, to meet their short- and long-term goals within a set total cost of workforce budget.

The goal of headcount planning is to ensure that the organization has skills coverage across departments to meet both today’s needs and tomorrow’s goals. It’s a collaborative process, involving human resources, finance, department managers, and senior leadership to account for high-level and ground-level requirements across the organization.

Three key benefits of headcount planning include:

Greater agility. The process ensures that organizations can audit their current position and adapt to changing markets, technologies, and company needs.

Better efficiency. Keeping tabs on what skills are present in the organization, and where they’re deployed, ensures that the right staff, with the right skills, are in the right positions to maximize impact and efficiency.

Stronger talent management. Headcount planning is a critical step to ensuring companies have the systems and processes needed to align HR, recruitment, and management strategies with core business objectives. It helps teams set talent goals, salary ranges, and bonuses with more transparency into how that impacts the company’s objectives.

These are just three examples of how headcount planning benefits an organization. The impact is wide-reaching, given that one of the most urgent themes for HR and workforce analytics leaders is to tie their work directly to business outcomes. With today’s climate of disruption—from technological shifts to economic volatility—people data delivers maximum value when it's connected to what matters most: productivity, performance, and financial impact.

The difference between workforce planning and headcount planning

Put simply, all headcount planning is part of a larger workforce planning initiative. But even if these processes are connected, they serve different purposes. Combining people data with work data ensures that both are aligned to develop resilience in your organization.

Workforce planning involves taking stock of existing human resources and reconciling them against current and future strategic needs. It doesn’t necessarily examine how many people are at the organization, how much they cost, and whether or not they’re in the right places in the organization chart.

Headcount planning is slightly different in that it aims to ensure that the organization has the right people in the right place and that the total expenditure is in line with the company’s budget. If they don’t, it helps to determine what steps need to be taken to either increase, decrease, or reorganize the headcount.

These processes are closely connected and can be most effective when done simultaneously. In fact, workforce planning remains constantly active, so analytics, like Visier’s People Real-Time Data Platform, helps HR and Finance align by integrating analytics and insights to produce measurable outcomes.

What is the headcount planning process?

The headcount planning process starts with agreeing on what challenges the company is hoping to solve, who should have input into the process, and where most of the attention should be.

Once those three questions are settled, the process is typically broken into nine key steps:

Establish success metrics. What organizational and HR metrics will you measure to audit existing headcount and performance? What does success look like for those metrics? What does failure look like?

Analyze and audit data. Use internal and external data sources to capture and analyze key data that informs success or failure points in the existing headcount and organizational structure.

Gather feedback from employees. Don’t forget to include employee insights into the audit phase. They will provide invaluable insights into ground-level operations that might be positively or negatively impacting progress toward goals. They can also help to flag areas where the company is under- or over-indexed on talent.

Evaluate the current workforce. Perform a gap analysis between where the company needs to be and what the current workforce can do. Look at the presence and distribution of vital skills across departments, and assess current performance trends.

Identify skills and hiring gaps. Focus on what skills exist in the organization and what skills are absent. Cross-reference that against current and future needs for the organization. In doing so, reflect on whether these skills gaps can—and should—be filled via internal mobility or external hiring.

Forecast costs. This is where the finance team comes in to establish a baseline cost for the workforce and forecast how much it’ll cost to fill skills gaps. They can also help to identify risks or over-indexing that may cause the headcount budget to exceed the company’s runway.

Creating a roadmap. Based on the workforce audit and cost forecast, is there room to hire new employees? Is the budget flat, meaning that a restructuring and retraining initiative is required? Or is the company over-indexed and over-budget on headcount, and requires a round of layoffs? Answer these questions to lay out your first roadmap.

Execute the plan. Roll out the plan as defined in the roadmap phase. Don’t forget to employ proper change management techniques to ease the impact of things like layoffs or restructuring. The goal is to keep the workforce intact as much as possible, without compromising performance.

Monitor results and remain agile. Keep track of core success metrics to ensure that the project had the desired effect. Stay aligned as a team to ensure that performance remains steady or improves, and that the ongoing talent initiatives remain within the defined budget.

Headcount planning remains a highly participatory, data-driven process that’s imperative to delivering outcomes by merging workforce and work data. The key stakeholders involved in the headcount planning are project managers, human resources managers, department heads, finance leaders, and other team members in executive leadership roles.

All of these key stakeholders will work together, using tools like Visier’s People Data Platform and Vee, to make the most of the HRIS systems, organizational charts, as well as first and third-party data sources they already have. The outcome is a line of sight that allows the headcount planning team to forecast real-time market trends and workforce needs.

Determining your workforce budget

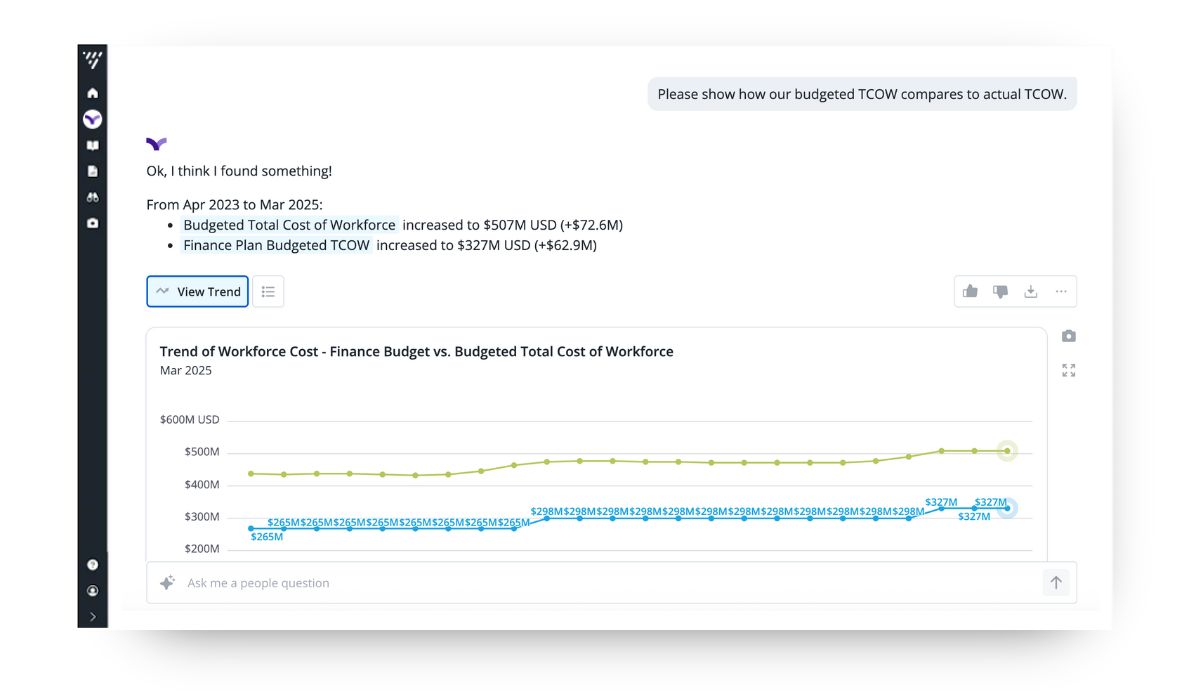

One of the important areas of headcount management is the total cost of workforce (TCOW). Here, Finance plays an even greater role. Finance team members use Visier’s analytics to plan for total workforce costs, working closely with HR to align workforce budgets to intended business costs and establish flexibility and strategic outcomes.

For example, as TCOW and headcount data from Vee are monitored in real time, the headcount planning team can pivot quickly in strategic decision-making while keeping HR and Finance aligned to maximize business results.

Using Visier's Vee to create a TCOW baseline is a breeze. For instance, if you ask Vee, "What was our TCOW budget versus our actual spend?", you have immediate insight into cost variances and issues. Likewise, if you ask Vee, "Show headcount change by location on a QoQ (quarter over quarter) basis", you instantly see how your workforce is distributed by location.

These workforce and work data analytics allow you to bring together revenues and expenses in real-time. This way, Finance and HR can compare actual spending versus their budget at a glance, evaluate whether your TCOW supports growth, or if you need to be cost-cutting. The data also allows for agility and adaptability, which is crucial in the fast-paced contemporary employment landscape.

When determining TCOW, include predictable turnover, retention, and foreseeable commitments such as promotions, raises, or bonuses. Remember that Visier's People Data Platform will support TCOW projection by making connections between your estimated TCOW and business-related KPIs.

3 ways HR and Finance work together on headcount planning

When it comes to headcount planning, it’s just as critical that all the players involved are in sync. If HR creates a workforce plan that doesn’t square up with the budget that Finance sets, all their work is in vain.

Finance has the breadth of expertise that’s required to create a company-wide budget. The scope of their annual budgeting task within the enterprise is monumental. They need to create a fiscal plan for the entire organization that takes into account organizational strategy, historical costs, future plans, and their best projections for how local and global economies will perform.

HR workforce planners, in turn, are the team members with an in-depth understanding of talent that’s critical for designing an effective plan. Their deep, specific insights into personnel and timing requirements complement Finance’s strength in painting the broader strokes of the budget. When Finance passes the budget to HR, HR planners need to be poised to use their expertise to deliver the ball to the company's goal line.

Here is how HR and Finance can keep in sync during three core planning stages.

Workforce budgeting and forecasting

Workforce planning is no longer an annual event. It’s a dynamic, continuous, collaborative effort that enables organizations to respond quickly to change. Strategic workforce planning succeeds when HR, Finance, and business leaders align on goals, scenarios, and trade-offs.

You can still have an operational plan for the year and a strategic workforce plan for the next two to five years. But you need the ability to run analyses in real-time and pivot as necessary in response to global and technological events.

In a typical organization, Finance sets headcount budgets once a year and then reviews them periodically to provide forecasts. Finance often starts a top-down process by aligning budget limits with corporate goals. Then, it switches to a bottom-up process, collecting realistic expectations from individual departments and groups.

However, the budget version that Finance delivers to HR is likely to be highly aggregated. It typically won’t contain information about the types of roles and locations for headcount, and it may not clearly articulate the impact each team should expect.

That’s where HR’s headcount planners need to step in to refine the budget and more accurately allocate the headcount. HR has the expertise and connections with the business to understand what roles and skills are needed and what timelines for hiring are realistic. HR will also have access to more detailed information about workforce dynamics and total costs that can inform their plan.

For instance, they’ll have insights into historic turnover trends, including seasonality in turnover, and they’ll have a holistic view of workforce costs, including costs for workforce events like relocation and recruiting that are sometimes overlooked when making plans.

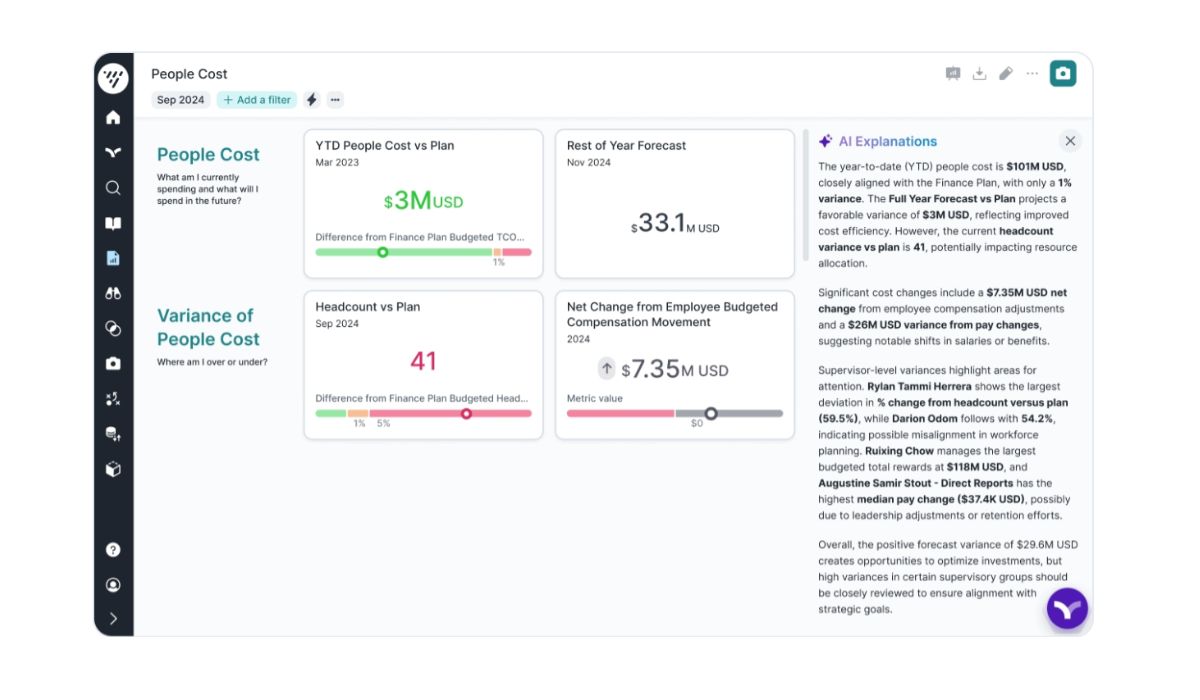

Visier’s Vee Boards give you a holistic view of metrics like “YTD People Cost vs. Plan” and “Rest of Year Forecast” to help teams adapt quickly to volatility:

Monitoring the budget and forecast vs. actuals

After Finance has set the budget, HR has generated the workforce plan, and the year is progressing, headcount planners will need to review actual performance and spending against the budget or most recent forecast. By doing so, they’ll be able to spot where headcount or spending is off track and decide on what action to take to get back on track.

In the workforce, up-to-date monitoring of the current situation is just as vital. To execute a workforce plan effectively, it’s imperative that the latest forecasts from Finance’s budget are brought back into the plan regularly to allow an accurate comparison. If Finance has provided a new forecast, it would be counterproductive for HR to compare their progress against the original budget.

Vee Boards reveals discrepancies like the 41 headcount deviation from the plan and the $7.35M USD net variance in employee compensation. These kinds of insights allow disciplined leaders to make course corrections quickly, while ensuring they are open to variations and changes within their budget parameters.

What-if/scenario evaluation

In workforce planning, the decision-making time frame may be more generous, but the need to review alternatives is no less important. If partway through the fiscal year, a key workforce policy changes or an acquisition is announced, how should workforce planners respond?

If a decision is made using intuition alone, it’s unlikely to be as good as a decision also backed by data. If headcount planners can access the current budget or forecast from Finance as well as accurate, up-to-date information about the workforce, they’ll be able to generate a series of alternative what-if scenarios, understand how they differ, and decide how existing plans should be revised.

The People Cost Vee Board above shows the key drivers that will help HR and Finance to model “what-if” scenarios. When correlating workforce and work data, teams can make data-driven decisions. Workforce plans will now easily change and evolve while keeping you on track to reach your desired workforce outcomes.

Driving towards a common goal

To ensure that everyone drives towards the same fiscal target, you need to distribute up-to-date budget limits from Finance to sub-planners such as division managers and HR business partners. The main planner in HR can then review sub-plans and see how they vary from finance’s fiscal-year-end goals before consolidating them into the final plan.

In short, an effective headcount planning process requires that HR and Finance work as a team. When Finance is in charge of managing the costs and HR is in charge of managing talent demand, combining people data and work data brings up a workforce plan that keeps the right talent together, at the right time.

Try a free Visier demo to encourage your HR and Finance teams to sync data with Visier’s People Data Platform.

Read more about headcount and workforce planning

Strategic workforce planning is critical in managing headcount, from finding and retaining the right talent within budget to developing their skills to support an organization's short- and long-term goals. Read more to learn what it is and how to do it.

Discover how savvy leaders are transforming their workforce with strategies that boost agility, skills, and innovation.

Visier's genAI assistant, Vee, answers strategic workforce planning questions in seconds. Here are 15 real examples of answers from Vee.

Learn why net talent retention is the key to measuring HR’s economic value and how organizations can leverage it to drive business outcomes.