Salary Transparency is More Complex Than You Thought—Here’s Why

There are many positive benefits of salary transparency, along with some complexities that companies and HR leaders need to be aware of. Read more.

Salary transparency has been identified as a potential positive impact on narrowing, or closing, gender and racial pay gaps. Companies are beginning to embrace the concept—some because they want to in an effort to build trust and an engaged workforce, others because state and local municipalities are beginning to require it.

New York City is one example. Effective November 1, city employers with four or more employees are required to post minimum and maximum salaries for any NYC-based job postings. California is working on a similar requirement and Colorado has had one in place since January 2021 through its Equal Pay for Equal Work Act which passed in 2019.

While there are many positive aspects of pay transparency for both organizations and employees, there are some complexities that companies and their HR leaders need to be aware of.

In an article for Harvard Business Review, researchers Leon Lam, Bonnie Hyden Cheng, Peter Bamberger, and Man-Nok Wong, point to three unintended consequences of pay transparency, based on a global study conducted in the U.S., UK, and China—the potential for pay compression, the potential for employees to request “special treatment,” and the potential for managers to accommodate these special requests.

Watch out for salary compression

Salary compression occurs when pay discrepancies between high performing employees and new hires become narrower, generally when internal pay increases don’t keep pace with the market.

When pay is transparent, managers are on the hook for explaining to employees why they may make less than a colleague. If pay decisions haven’t been made objectively and consistently, that can put them in a tough position.

Put on the spot, researchers found these supervisors assumed a “self-protective approach,” making employees’ performance incentives more similar, leading to compression. They point to other research supporting their findings—a study that found that city managers in California suffered a 7% average compensation drop when pay was made transparent, and a study in academia which found that pay transparency resulted in “academics being paid more similarly to their peers.”

The negotiation of personalized rewards

When pay becomes transparent and employees feel concerned about their peers knowing they’ve received a pay increase, they may look for other ways to get the rewards they feel they deserve. This might include “additional training for career development purposes or supplementary health benefits.” The researchers refer to this as idiosyncratic or “i-deals.”

So, in lieu of a bump in pay that others become aware of, an employee might instead ask for more time off, a more flexible schedule, or other personalized rewards. And supervisors are highly likely to accommodate them. This can lead to additional inequities in terms of total compensation, not just salary.

Supervisors likely to feel pressured fulfill personalized requests

When faced with employee requests for i-deals, supervisors were likely to accommodate these requests both to positively impact team performance and because these deals could be done outside of the pay transparency process.

Companies that had a stronger “collectivist work culture, where people prioritize working together over working independently,” the researchers say, are more likely to generate and grant i-deal requests. That undermines the value of pay transparency and “may come at the cost of gender pay equity,” they say. Even though workers may not be expressly trying to “game the system,” the effect of these side deals can amplify disparities between staff members in ways not directly tied to salary.

In addition to these potential complexities, employers may also feel pressured to make major adjustments to their existing pay scales as inequities become obvious.

Getting to pay equity

When companies decide, or are required, to institute pay transparency, most—if not all—are faced with the challenge of addressing the variations that likely exist within their organizations. That means taking a potentially major salary budget hit as salaries are adjusted to create greater parity, or feeling the negative effects from employees who find that they’re not being paid equitably. Depending on how significant the variations are and how many employees are affected, organizations may not be able to bring all employees to parity immediately. And that can result in frustration among employees, leading to dissatisfaction, disengagement and—potentially—turnover. Organizations have to balance that potential with budgetary constraints.

The impacts of salary increases can be especially difficult for small and mid-sized companies. In addition, smaller companies may be challenged to invest in often costly market data on salary ranges to help them level-set their salaries to the market.

Addressing the complexities of pay transparency

Being aware of unintended consequences of pay transparency can help companies strategies and methods in place to combat them. For instance:

Making the link between performance and rewards very clear and objective.

Training supervisors and managers in communication related to pay practices.

Auditing salaries to ensure that they are equitable and aligned with offers to new hires.

There are other ways to skirt the issue, though, as Inc. points out. In Colorado, for instance, after its Equal Pay for Equal Work Act went into place, job listings declined while employment increased, suggesting that employers simply didn’t post jobs—but may have gone through recruiters to reach out directly to candidates—to avoid needing to publicly share ranges.

In other instances, companies may simply post very broad ranges. For instance, CBS News reports that “some employers are posting jobs with pay ranges whose lows and highs span $100,000 or more.”

Despite these potential workarounds, though, progressive employers committed to attracting, retaining, and effectively engaging employees will likely recognize the value that being transparent about pay practices can bring.

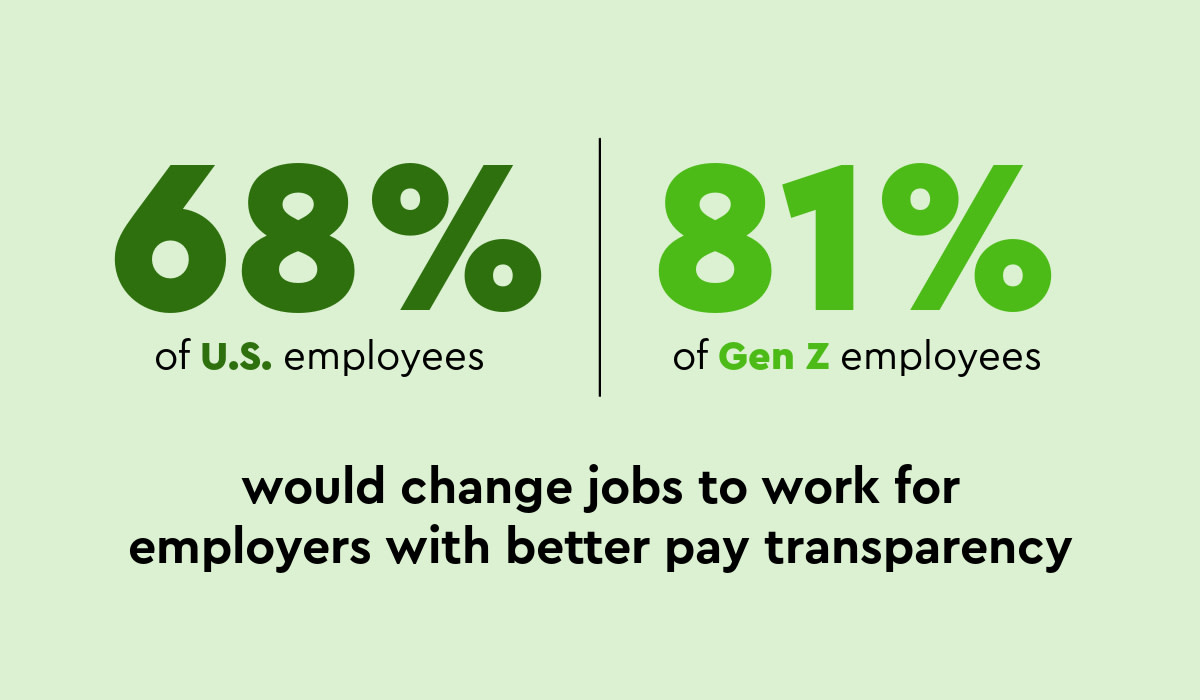

Visier research shows that 68% of U.S. employees (and 81% of Gen Z employees) would change jobs to work for employers with better pay transparency. It can be an effective way to attract and retain talent and drive better employee engagement.

It’s also a potentially powerful tool to use in the quest to address wage gaps for women and people of color. According to Inc., “A pay transparency report examining the gender wage gap from PayScale, a Seattle-based software firm, shows that disclosing wages narrowed the gender wage gap in 11 out of the 15 industries examined.”

While California and a few other states may be ahead of the curve when it comes to requiring pay transparency in job postings, chances are these regulations will ultimately trickle to many other states. Additionally, many employers recruit from, or have offices in, multiple locations. It pays to start thinking now about how your company will proactively address emerging pay transparency requirements.