Employers Are Bumping Pay To Ease Stress of Living Paycheck to Paycheck

Living paycheck to paycheck causes financial stress for many Americans. Find out how this impacts employee productivity and how employers should respond.

For Matrice Moore-Carr, living paycheck to paycheck means continually asking questions. “Am I going to have to cut my meals back? Am I going to have to eat once a day as opposed to three? I don’t know. It’s just tough.”

When Matrice shared these worries for a New York Times story published last June, she was juggling her regular job as a registrar at a public hospital in Nashville along with overtime shifts in the ER and part-time work as a hotel receptionist. She was working seven days a week—and still struggling to make ends meet.

Her story captures the harsh realities of living paycheck to paycheck. And she is not alone.

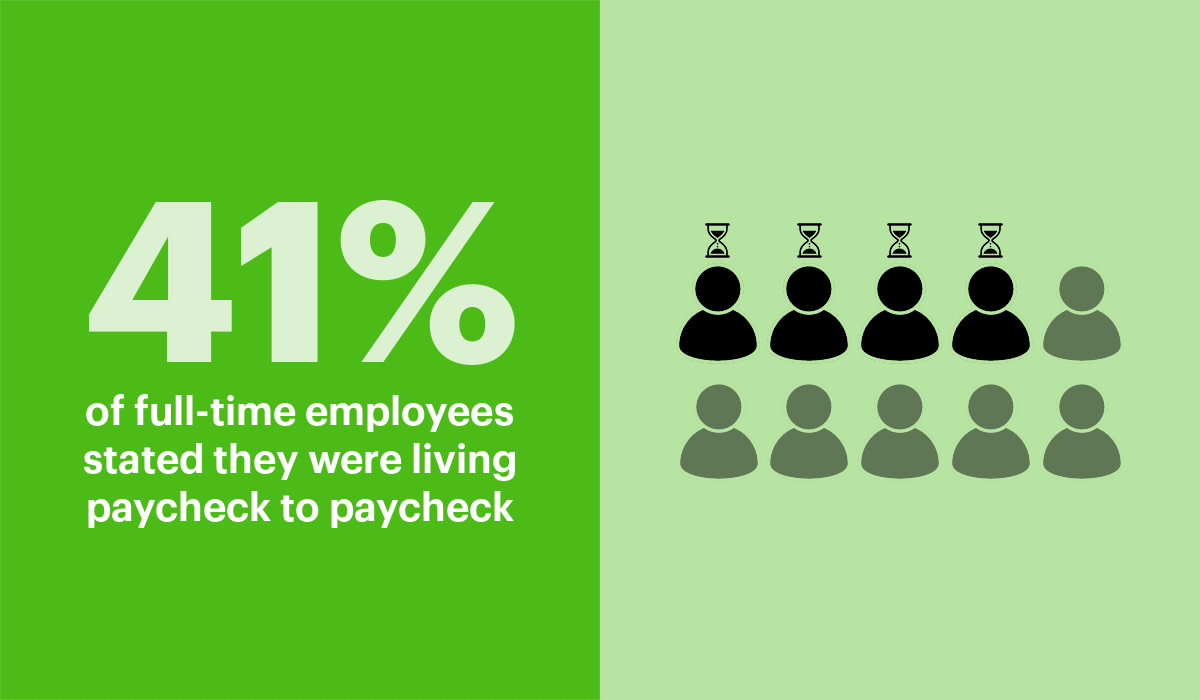

Living paycheck to paycheck not uncommon

According to findings from WTW’s 2022 Global Benefits Attitude Survey, 41% of full-time employees stated they were living paycheck to paycheck, up from 38% in 2019. While the phenomenon is spreading faster among workers in higher income brackets, employees living in this situation are more likely to be younger, a single parent, and earning less than $50,000 per year.

The survey, conducted during December 2021 and January 2022, illustrates a precarious situation that is only getting worse. In June 2022, the US inflation rate hit 9.1%—a 41-year high. It eased somewhat the following month, but remained elevated at 8.5%.

What U.S. consumers were able to buy with $100 a little over a year ago now costs around $110—a big problem for those who were already struggling to put food on the table and keep gas in their cars.

Financial stress is a business issue

Financial stress is an issue that employers are taking seriously. First and foremost, widespread hardship is a humanitarian concern.

It’s also a business problem, particularly within the context of the Great Resignation. According to PwC, financially-stressed employees are twice as likely to be looking for another job.

Beyond turnover impacts, living paycheck to paycheck causes productivity concerns: Employees experiencing financial stress are also more likely to be facing mental health issues that create problems with attendance and engagement.

Financial hardship is also a source of labor unrest (as evidence, consider what’s happening in the UK and other parts of the world). This leads to service interruptions and production losses—not to mention an erosion of trust with customers. Factor in the fact that CEO pay hikes far outpaced the rate of inflation in 2021, and there’s a recipe for widespread discontent (among workers and investors alike).

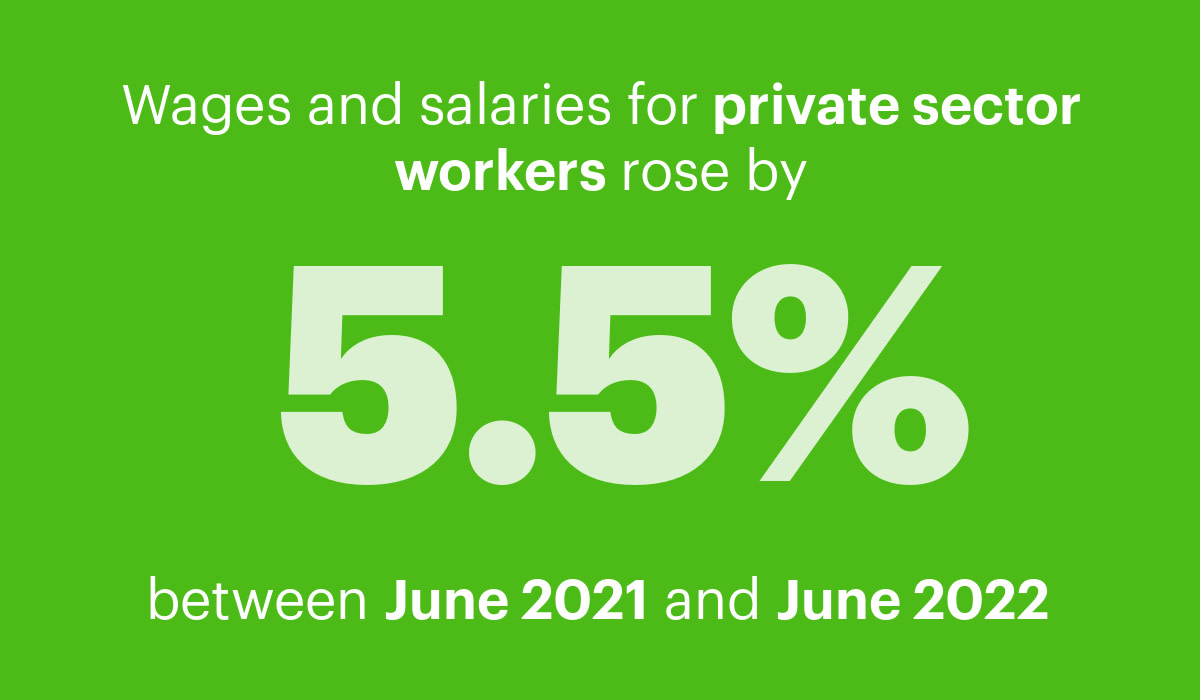

Organizations are responding with wage increases

Against a backdrop of labor shortages, employers are taking action and bumping up pay. Typically, annual pay raises hover around 3%. But wages and salaries for private sector workers rose by 5.5% between June 2021 and June 2022.

According to a Gallagher survey of 800 US companies, nearly two-thirds of employers stated they were increasing compensation budgets due to inflation. A quick poll conducted by Pearl Myer found that among those organizations handing out salary increases in 2022, 44% stated retention was the primary driver, and 30% stated cost of living and inflation was the main factor.

Recently, simPRO, a business management software company, took dramatic steps to combat inflation’s impact, announcing an inflationary pay increase of up to 10% for every employee who earns less than $80,000 per year.

Increasing compensation strategically

Determining how to raise wages sustainably is a complicated undertaking. The right way to approach compensation increases is to look at them in the same way you would any business investment, says Ian Cook, Visier’s VP of People Analytics.

“You need to gather data about the market and use it to answer key questions: How much do we need to spend in order to stay competitive in our key talent areas? Where will higher levels of investment help to sustain or grow our talent advantages relative to competitors?” he explains.

This requires the creation of different scenarios, as well as forecasting the potential impacts of increases on overall costs, retention, and employee productivity. “The use of data is essential to establishing the best decision because the range of choices and their associated business impacts are too complex to rely on guesswork or instinct,” he adds.

Another significant change taking place within the lower pay brackets is the introduction of earned wage access, which gives employees access to their money as soon as they have earned it—rather than having to wait two weeks to get paid.

Beyond pay, creative measures include providing help with student loan assistance and daycare subsidies. To ease financial pressures, smart organizations are giving employees who work in roles that can be performed remotely the option of working from home. This can put employees in the driver’s seat when it comes to managing their finances and it also alleviates “pay to work” sentiments due to high commuting costs.

Other responses include adjusting packages to focus on injecting more short-term cash flow directly into employees’ pockets by rethinking retirement benefits.

For those employees who are in higher income brackets, existing benefits, like financial coaching can also help, Ian says. Indeed, financial coaching was one of the top three fastest growing voluntary benefits between 2020 and 2022.

While it’s a lower-value response for workers who have less income to manage, it can be a good strategy for employees who have a little more flexibility, yet are still concerned about their finances, he adds.

Will inflationary pay increases continue?

When organizations can’t fill a huge volume of open roles fast enough, the business case for bigger compensation budgets is stronger. But there are signs that the quit rate among hourly paid employees is declining.

Visier data shows reduction in resignations in the retail, wholesale, warehousing, and transportation sectors—sectors with a high proportion of hourly paid employees who are likely to be living paycheck to paycheck. This leads to the question of how long the inflationary pay increases will continue.

Experts are also predicting that efforts to tame inflation will trigger a recession and generate an increase in the unemployment rate. As Craig Torres and Catarina Saraiva write in this Bloomberg piece, this “would allow companies to revert to old habits of using job insecurity to hold down wages and rebuff workers pressing for better conditions.”

Future-focused employers step up

But Joseph Fuller and William Kerr (a pair of academics from Harvard Business School) offer a different perspective. In this HBR piece, they point to longer term demographic trends and argue that the “Great Resignation was no anomaly; the forces underlying it are here to stay.” Future-focused employers will continue optimizing their resources to meet the needs of their employees—and gain a competitive edge.

What compensation budgets will look like a year from now is unclear. But what is certain is that the labor pool is shrinking. We have entered into a new reality when it comes to the employee-employer relationship, and those organizations that will thrive longer term will be those who meet the needs of employees now—and that includes stepping up to address financial stress.

New research reveals pay transparency is a topic employers can’t ignore. Click here to read the report.

On the Outsmart blog, we write about workforce-related topics like what makes a good manager, how to reduce employee turnover, and employee burnout. We also report on trending topics like the Great Resignation and preparing for a recession, and advise on HR best practices like how to present headcount data to your CEO, metrics every CHRO should track, and connecting people data to business data. But if you really want to know the bread and butter of Visier, read our post about the benefits of people analytics.